View Code Here

# Get the R files containing the functions with plots

purrr::walk(list.files(

'docs//01-Visual-Storytelling//01-Capital-Allocation//functions//',

pattern = "\\.R$", full.names = TRUE),

source

)Daniel Carpenter, MS

2024

For demonstration only, the data are randomized and all naming is fictitious.

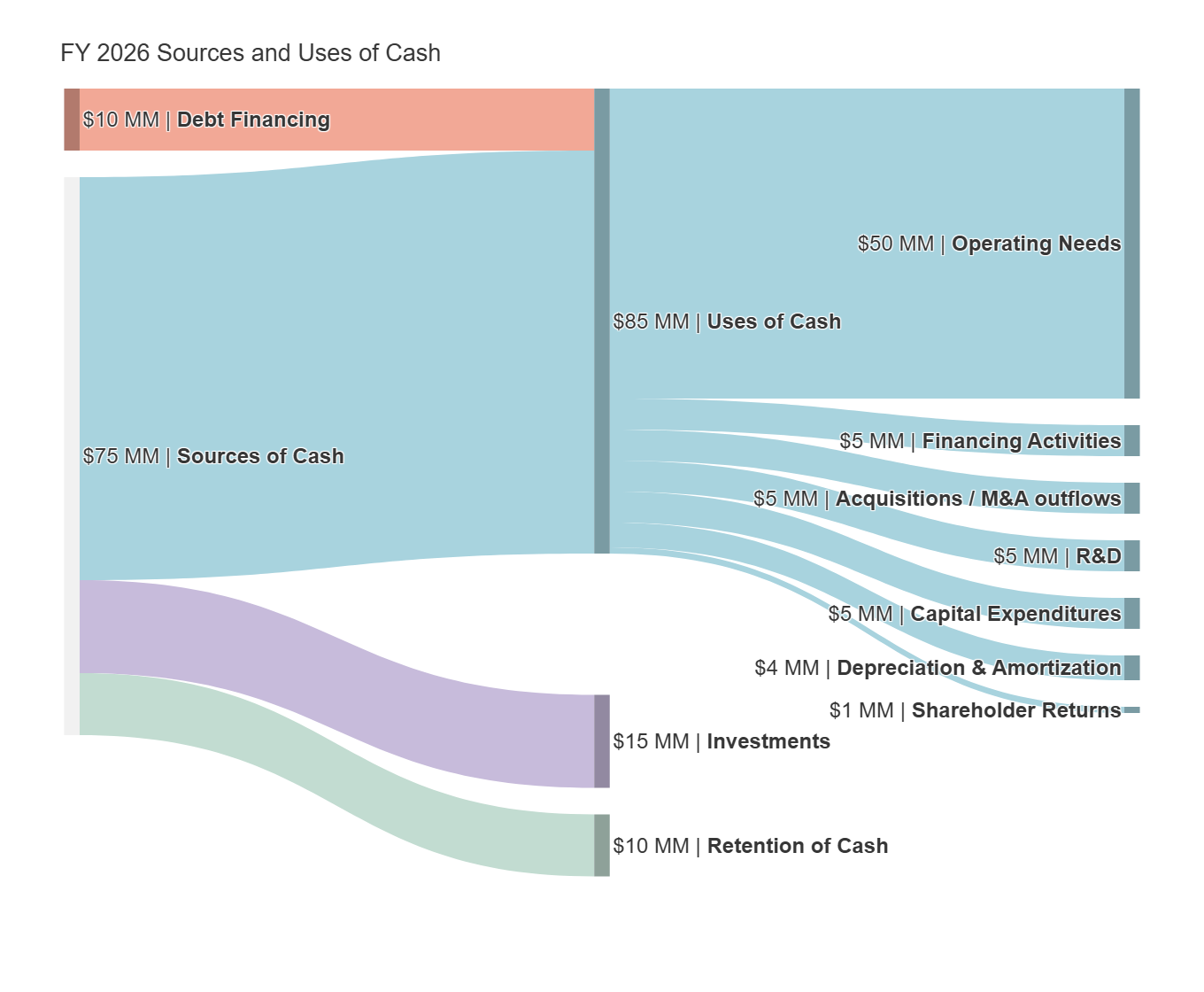

Cash from multiple sources was consumed by day-to-day operations, leaving little for investment or growth.

Forecasts show anticipated reliance on debt to cover operating cash needs, raising future financial risk.

Actual allocations drifted outside targeted ranges, signaling opportunity for enhanced controls and capital framework implementation.

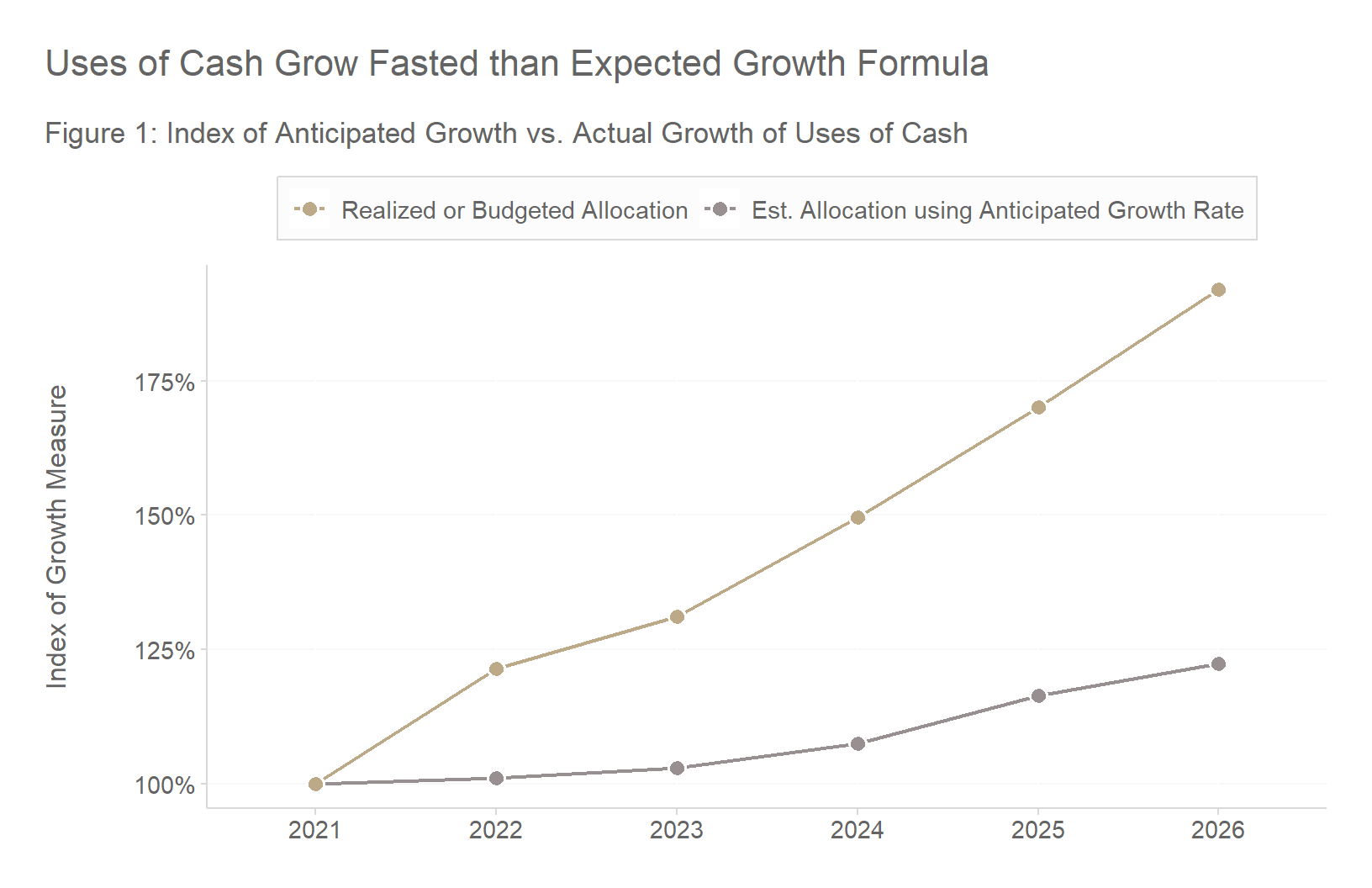

Realized growth outpaced planned levels, but capital use did not align with a sustainable model.

Provide leadership with a range of growth scenarios to guide decisions in the upcoming budget cycle.

By redirecting more cash into investments, the business could have built a steady, recurring income stream.